No one ever wants to experience anything that could harm their physical or mental health. Whether you are the victim of a workplace or work accident or medical negligence, there is no denying that going through this kind of situation can be incredibly disruptive.

Regardless of the intensity of the physical injury suffered, you will still be very much affected by this. Not to mention that your mental health will also be in poor condition given the emotional and mental distress one can be under when they are involved in an accident.

Medical negligence claims are among the most complicated ones. Individuals who are victims of this can be incredibly affected, especially if this happens due to the irresponsibility of a trusted medical team. But even though the accident was caused by a randomly assigned doctor or another member of a new medical team who is not acquainted with the patient and their health condition, it is still a highly disruptive incident to go through.

Doctors and medical providers are meant to heal, not harm. So, naturally, it is extremely common for victims of medical negligence claims to be in utter shock, given that no one expects something like this to happen. Indeed, there is a minority of doctors who aren’t entirely dedicated to their patients and committed to acting responsibly at all times. However, even though they are few, it is crucial to discuss what needs to be done if involved in a medical negligence claim.

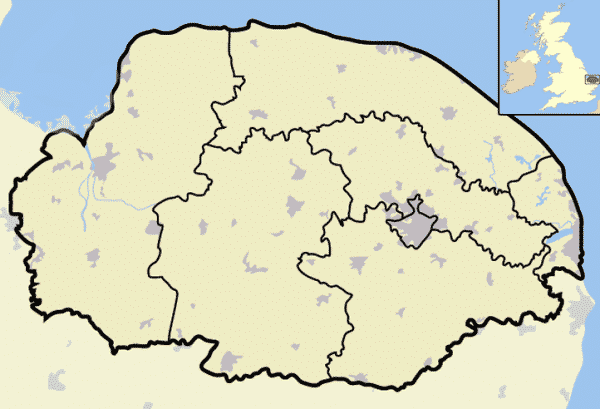

First of all, it is crucial to mention that you can sue the NHS if you have reason to believe they could have prevented your injury from happening. According to How-To-Sue, if you have been a victim of personal injury that could have easily been avoided provided the NHS had given the necessary attention to it, you are eligible to claim compensation for medical negligence.

Second of all, once you know you can claim compensation and the cases that can be brought to court, it is crucial to learn all the steps necessary and valuable aspects that could help you build a solid case. So, here goes:

What represents medical negligence and how can you identify it?

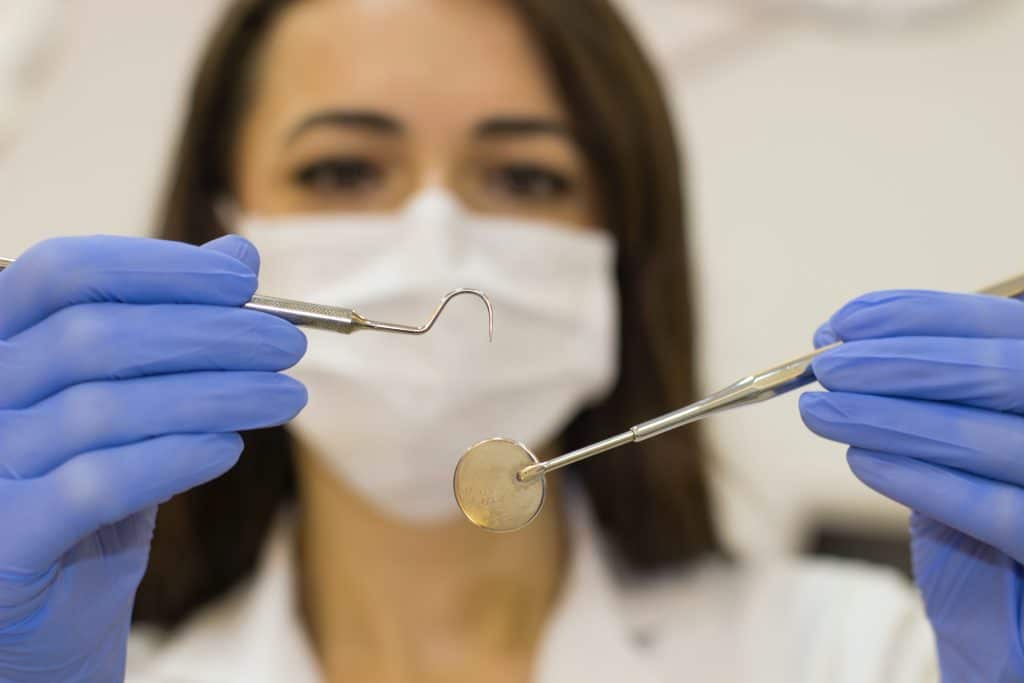

Medical negligence happens when any healthcare provider and medical professional fails to deliver proper medical care and sets the wrong diagnoses and course of treatment due to neglectful care and attention to patients.

Hospitals and healthcare professionals are expected to adhere to a certain standard of care when it comes to their patients. Indeed, they are not responsible for everything that may happen. However, they are legally responsible for the patient if the patient suffers an injury or any type of harm due to the healthcare professional’s lack of care and quality, as was expected of them. If the healthcare provider knowingly neglects their job, all these aspects point to medical negligence.

It is crucial to list some of the most common causes representing medical negligence to identify these cases. Plus, you may be able to understand your personal situation better.

- Premature hospital discharge without proper investigation;

- Misdiagnosis, delayed diagnosis, or failure to do so;

- Incorrect medication prescription or administration;

- Wrong anaesthesia administration;

- Mistakes in surgeries followed by negligent post-op care;

- Lack of proper prenatal care and negligent childbirth.

A noteworthy mention would be that these are not the only medical errors that can lead to and represent medical malpractice but are among the most common ones. Knowing this will help you identify whether you have been a victim of medical negligence. You may need a professional lawyer to help you with this case, no matter your situation and how you became a victim.

Gather evidence to prove the medical negligence case

Physical evidence is of the utmost importance when you want to claim compensation for personal injury, but even more so in medical negligence cases when you decide to sue the NHS. Without this, it is highly unlikely your case will be solid enough to win, get justice and fair compensation to cover all the expenses that occurred from this unfortunate experience.

For this reason, it is of the utmost importance to keep everything related to your medical negligence case, from conversations you have with the healthcare providers in question, photographs documenting the entire experience, to medical bills and any other expense included.

Apart from this, it is vital you have a few medical witnesses. They can provide a professional opinion that can confirm the act performed by the healthcare provider counts as negligent and is the leading cause of damage and harm to the patient.

Hire a personal injury lawyer with vast expertise in medical negligence

It is highly recommended you hire a personal injury lawyer with vast and well-established expertise and knowledge for medical negligence cases. Mainly because you are too close to the case and, hence, extremely subjective, a solicitor will be able to professionally handle all the aspects of your case, maintaining an objective view while also having your best interest in mind.

What’s more, a lawyer will be able to request all your medical records and notes from the medical provider, given that they have the authority to do this. Plus, when it comes to questioning medical witnesses and other key individuals, they can do it professionally, thanks to their questioning and negotiation skills.

And you shouldn’t worry about the costs involved in medical negligence cases and paying your personal injury lawyer. The Conditional Fee Agreement, also known as the “no win no fee” basis, allows victims to hire a professional lawyer and pay them a specific percentage only if the case is won.

Know the time limits that apply to medical negligence cases

Taking legal action against a medical provider or the NHS is not an uncomplicated or straightforward process. Although most healthcare professionals are precisely this – professionals individuals who are committed and dedicated to their jobs – sometimes things can go wrong. And when a medical negligence case happens, it is crucial to speak up and take legal action.

For this reason, it is crucial to know the time limits in medical negligence cases. There is a three-year limit from the moment the accident occurred or when you first realised its consequences. In instances where the victim is unable to make a claim for clinical negligence, a parent, guardian or close person can do it on their behalf.